UPDATE: I wrote this article in early 2020 but updated a bit in mid-2024.

There is a US election, the World Cup, and the Olympics every four years. They don't all happen in the same year, but they each have a four-year cycle.

Today, there's another event that happens once every year that few talk about: the Bitcoin halving.

To celebrate, I'll give a simplified explanation of what the halving is and why it's significant.

Afterward, I will turn to a more fundamental question: why is Bitcoin (BTC) worth more than a dollar, and why do I keep talking about it given that I'm mostly known for my travels?

What is the Bitcoin Halving?

Every 10 minutes, a fast bitcoin miner somewhere on the planet is rewarded for his efficiency. When the Bitcoin network was first created in 2009, that reward was 50 bitcoins. Every four years, that reward is cut in half.

On May 12, 2020, Bitcoin underwent its third halving. The reward dropped from 12.5 bitcoins to 6.25 bitcoins.

In 2024, the reward became 3.125 bitcoins.

In 2028, the reward will be 1.5625 bitcoins.

This halving will continue every four years until it stops in 2140. At that point, we'll have 21 million bitcoins.

Why is the Bitcoin Halving significant?

You're probably familiar with the US Federal Reserve injecting more liquidity into the economy. Some refer to it as "printing money boosts the economy." It's also called Quantitative Easing (QE).

When the Fed does that, it devalues the dollar. When it does that for a long time, it adds up. That's why $1 during George Washington's time would be worth 1 cent today.

Bitcoin does the opposite. Instead of printing more Bitcoin every year, we print less every four years.

Therefore, the dollar softens over time, whereas Bitcoin hardens.

Assuming bitcoin's demand grows slowly, the price will still rise because the supply is growing slowly nowadays.

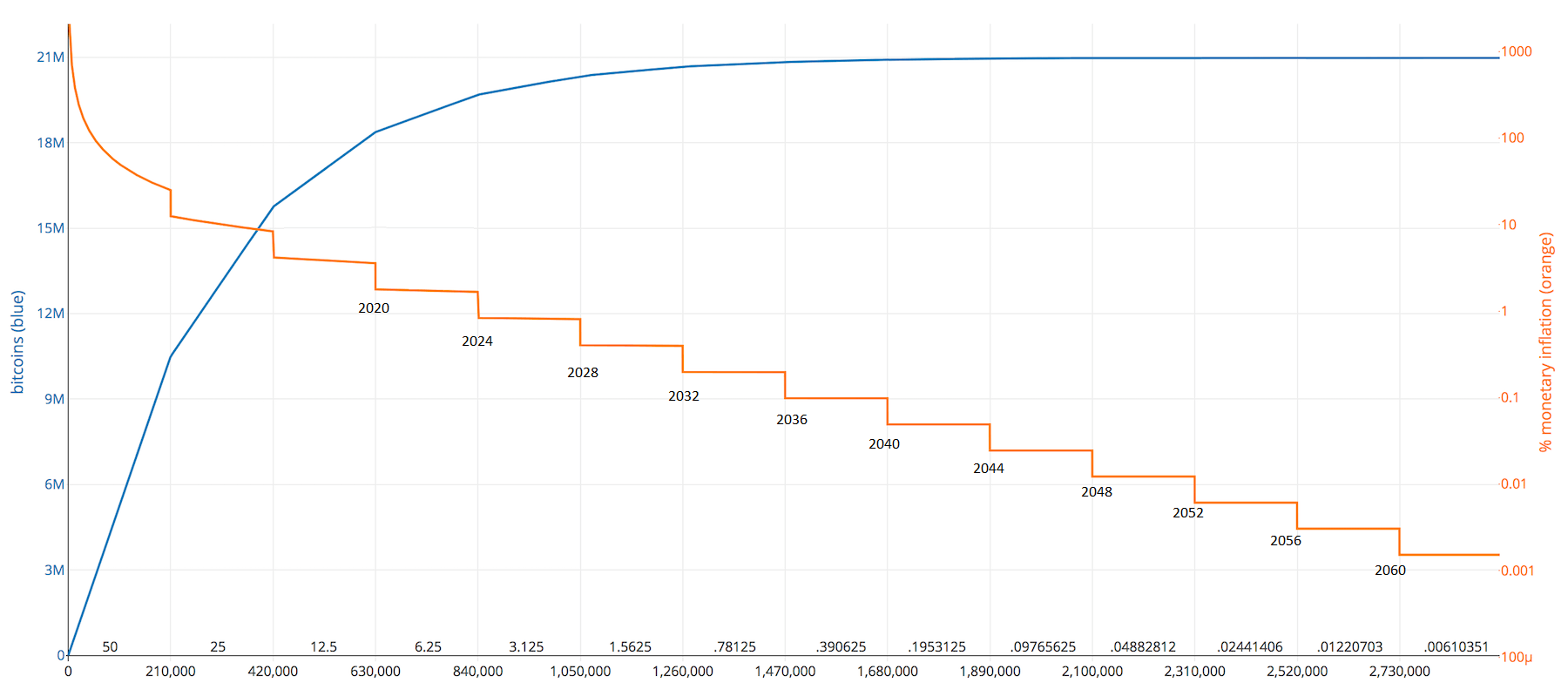

The graph below shows how Bitcoin's inflation rate will drop from about 3% in 2020 to below 1% in 2024. And it keeps declining until it has 0% inflation in 2140.

No other asset in history has had 0% inflation. Gold has low inflation, which has helped it retain its purchasing power. Still, we're constantly digging more gold out of the ground. Gold mining inflates the supply by 1-3% per year. As gold's price rises, miners have more incentive to dig for more.

Bitcoin doesn't work that way. By 2140, there will be no more bitcoin to mine. Even by 2036, bitcoin's inflation rate will be 0.1%. In comparison, gold will be at least 10 times more inflationary than bitcoin in 2036.

Shouldn't Bitcoin be worthless?

Skeptics are dumbfounded about why bitcoin is worth more than a penny. They believe Bitcoin is "fake internet money and one big Ponzi scheme."

Those who declare that Bitcoin is a Ponzi scheme don't understand what a Ponzi scheme is and/or don't understand Bitcoin. Others incorrectly call it a pyramid scheme.

You can certainly accuse Bitcoin of being an economic bubble (like the Tulip mania), but it's not a classic Ponzi scheme.

It's also not a pyramid scheme any more than a company stock is a pyramid scheme.

When an asset bubble pops, the asset's value rarely drops to zero. Even tulips still have value. So why does Bitcoin have any value?

There are many long articles and videos explaining why Bitcoin has real value. Here's a quick explanation.

Bitcoin has 14 of the 15 key properties of money. Bitcoin is:

- Scarce: only 21 million bitcoins will be mined (and 90% have already been mined).

- Durable: it's as durable as the Internet itself.

- Portable: you can carry millions of bitcoins in your head by memorizing 24 words.

- Divisible: one bitcoin equals 100 million Satoshis. One Satoshi is currently worth $0.00007084

- Easy to recognize: yes.

- Easy to store: yes, it can be stored on almost any digital device as well as written on paper or memorized.

- Fungible: yes, bitcoins are mutually interchangeable, just like any currency.

- Hard to counterfeit: unlike other currencies, nobody has ever counterfeited bitcoin

- Widespread use: it's used anywhere where there is the Internet.

- A medium of exchange: thousands of businesses accept it.

- Store of value: although highly volatile, it was the best-performing asset from 2010-2020 (9 million percent return).

- Able to earn interest or be offered as a loan: companies like BlockFi allow you to earn interest or get bitcoin loans

- Available on debit cards: many bitcoin debit cards allow you to pay in your local currency by instantly withdrawing from one of your Bitcoin wallets.

- Available on credit cards: companies like Fold and Blockrize offer bitcoin-friendly credit cards.

- A unit of account: not yet. It's hard to find businesses that price their goods or services in Bitcoin. Many businesses accept bitcoin but list their prices in the national currency or USD/Euros.

Regarding #9 (widespread use), it's worth watching this 10-minute video about a guy who has been living solely by earning and spending cryptocurrency for the last five years. He has no bank account, credit cards, or cash. He fuels his car with Bitcoin, recharges his cell phone, and even pays his taxes with it.

Although bitcoin fails the last criterion, let's remember the importance of the first criterion: scarcity.

Gold is relatively scarce, but even if we mined all the gold on the earth, gold's supply wouldn't be exhausted. In this century, you can bet that the gold market will crash once we mine this asteroid:

Bitcoin, in contrast, has a 21 million cap. Yes, if the majority of the Bitcoin holders and miners agreed to create more Bitcoin, they could. However, that would destroy most of the value and be economic suicide. Therefore, it's safe to say that bitcoin is the scarcest commodity or currency.

Still, critics insist, "But bitcoin isn't real like the US dollar!"

Yuval Harari said it best:

Money, in fact, is the most successful story, ever invented and told by humans, because it is the only story everybody believes. Not everybody believes in God, not everybody believes in human rights, not everybody believes in nationalism, but everybody believes in money."

Jump to 11:25 of his brilliant TED talk:

The US dollar is no more real (or fictional) than Bitcoin.

Eric Posner, a law professor at the University of Chicago, stated, "a real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion."

True! Posner should have added, "And all money is a collective delusion."

Ultimately, bitcoin has value for the same reason any currency has value: a critical mass of humans have decided it has value.

Why bitcoin is here to stay

Several things indicate that bitcoin is not a fad.

Bitcoin is a global phenomenon. People from all cultures have managed to understand and value it, and Bitcoin mining rigs cover the planet. Tulips were mainly hot in the Netherlands.

Speaking of tulips, Bitcoin has been battling them for 15 years. Tulipmania lasted for 6 months. Other dubious financial schemes fizzle quickly.

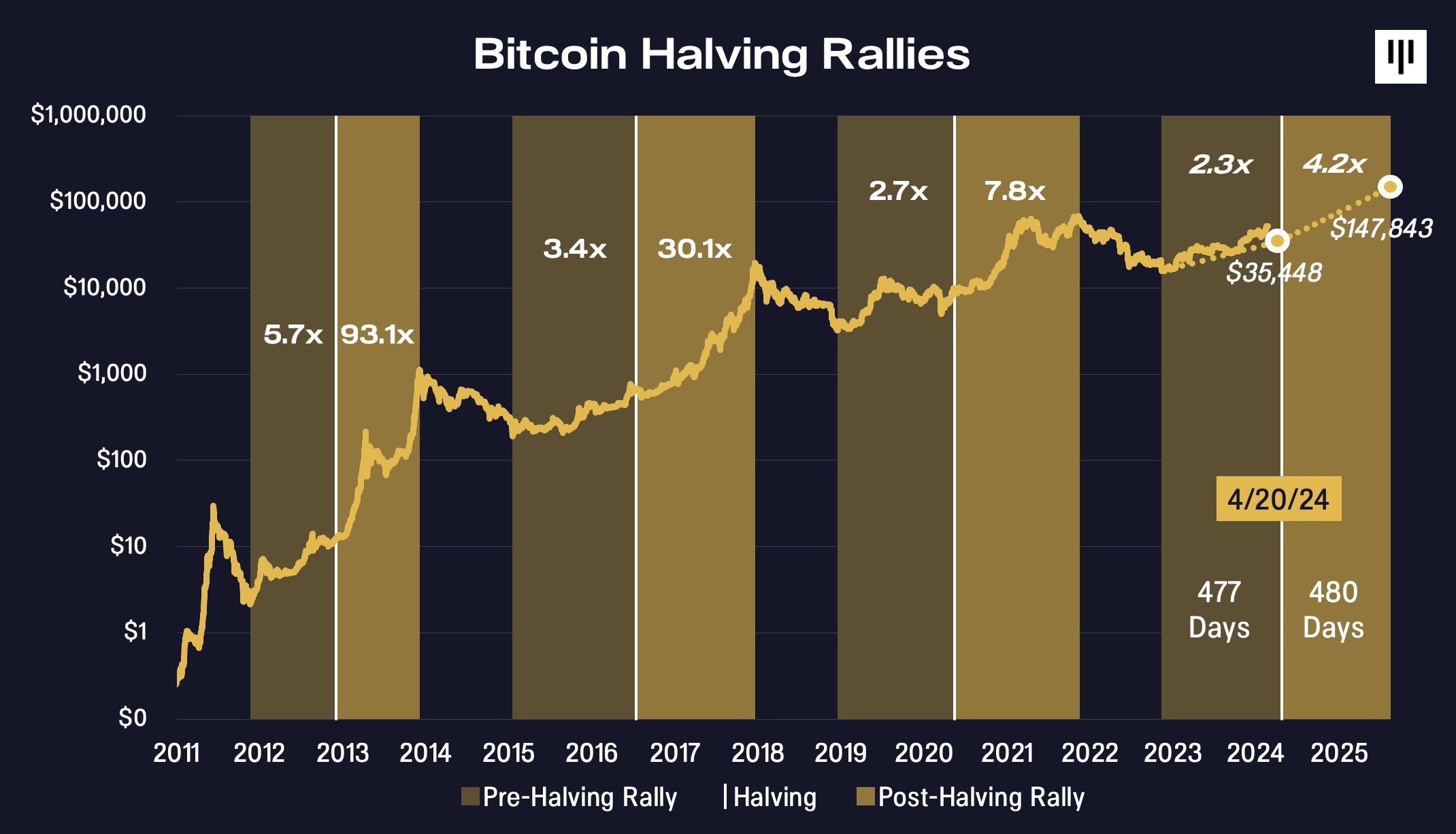

Bitcoin has survived at least five significant crashes. Each crash has brought people to say, "Bitcoin is dead!"

The declines are brutal. They usually range from 70-85% declines!

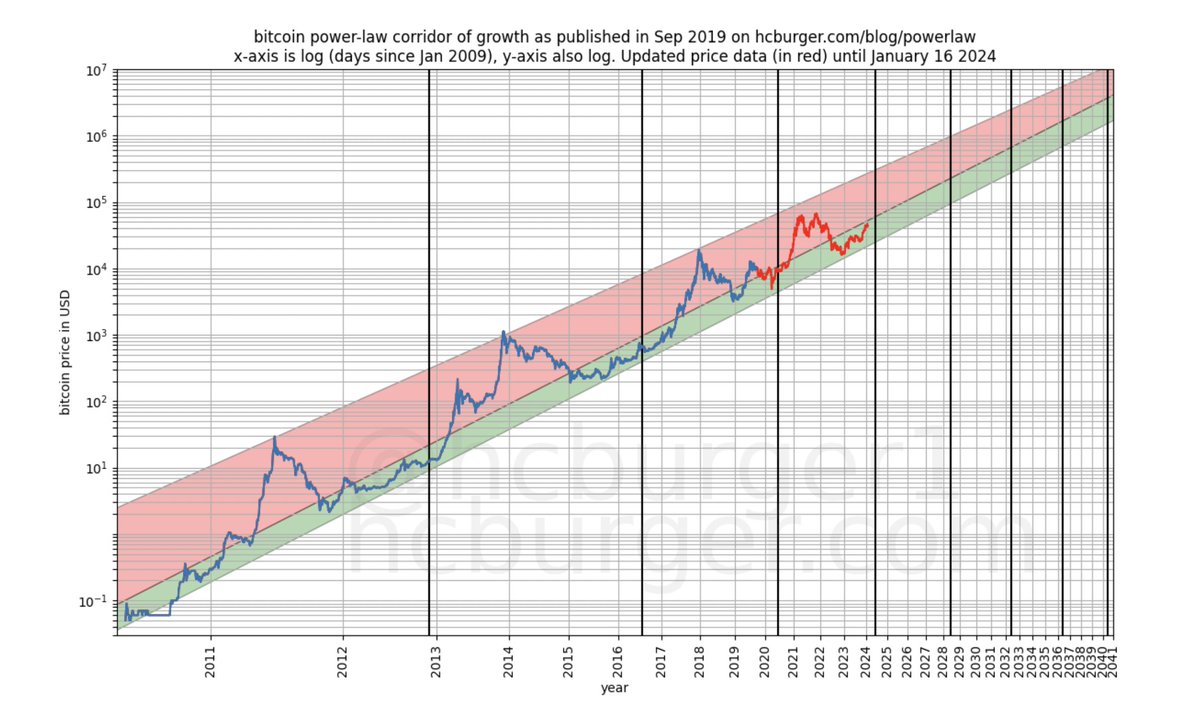

However, when the dust settled, bitcoin created a new low that was higher than the previous low. This is significant. It proves Bitcoin's resistance. It forms a new base and starts climbing again. When it crashes, the price never revisits the previous low.

Bitcoin is too big to fail

Bitcoin's creator, Satoshi Nakamoto, didn't want to help Wikileaks because he knew the US Federal government could easily crush the fragile monetary experiment. Nakamoto preferred that bitcoin stay below the mainstream radar until it amassed more nodes worldwide.

In 2024, there were over 15,000 bitcoin nodes in 100 countries. As a result, it's nearly impossible to pull Bitcoin's plug. If 20 countries attempt to close all their Bitcoin nodes (which is extremely difficult to do), the Bitcoin network will keep humming along with the thousands of nodes in other countries.

Think of Bitcoin like an operating system (e.g., Windows, iOS, Android). Popular operating systems attract a massive ecosystem around them. Network effects reinforce the utility of the operating system. The more apps are developed for the operating system; the more people want to ensure that it stays healthy and keeps improving.

With a market cap of over $1 trillion, Bitcoin has created a massive industry. Armies of software developers are feverishly developing applications that use Bitcoin, and venture capitalists have invested billions in Bitcoin-related projects. It's now a beast that's hard for the government to tame.

Bitcoin in 2024 feels like the Internet in 1994. It's beyond infancy, but most people still haven't dipped their toes. Still, the network is building out.

Of the roughly 750 currencies that have existed since 1700, only about 20% remain, and of those that remain all have been devalued. - Ray Dalio

On December 31, 2017, I predicted that bitcoin would crash to $4444 in 2018. Bitcoin's price tumbled from nearly $20,000 to $3,200. While I watched the price collapse, a lightbulb went off in my head.

Here's what sealed the deal for me. Throughout 2018, I would listen to podcasts and read news about Bitcoin. What was fascinating was that Bitcoin developers were plowing full steam ahead with complete confidence. The geeky podcasts and websites discussed the rapid progress in various Bitcoin-related projects even as Bitcoin's price was tumbling down the abyss.

Developers and CEOs of Bitcoin-related companies hardly seemed to care because they knew Bitcoin would resurrect itself. Developers secretly prefer working during bear markets because crashes eliminate all the riff-raff and short-term speculators. Only the purists stuck through the hard times. With a smaller network and more technical users, they could work out the bugs before the next bull run.

At that point, I realized that Bitcoin would bounce back and was remarkably resilient. In December 2018, I predicted that Bitcoin would double in value in 2019 and reach $7,300. It ended 2019 at $7,333.

Bitcoin crashes will return, but I predict they will not be as extreme as those in the 2010s. Bitcoin's first crash dropped its value by 94%!

I suspect that crashes in the 2020s will rarely exceed 80%.

They will rarely exceed 40% in the 2030s and so on. As Bitcoin becomes more widely dispersed, its volatility will resemble that of small-cap stocks. That's because, unlike the stock market, Bitcoin trades nonstop and "circuit breakers" to stop a precipitous drop, as the US stock market has.

Another sign that Bitcoin is entering the mainstream is that CNBC, the financial cable news network, regularly reports on Bitcoin. Mainstream news media only mention BTC when it's experiencing extreme highs or lows. However, in the 2020s, I predict that you'll see BTC mentioned as often as gold in the mainstream media's financial summaries. When that happens, it will increase the awareness and the demand.

Answers to Common Criticisms

Below are the 10 most common criticisms people have about Bitcoin.

1. It's not real money and has no intrinsic value

Short Answer: Fiat currencies have no intrinsic value since they are not backed by gold and can be devalued at any moment. Long answer: see above.

2. Sure, bitcoin is scarce because it only has 21 million bitcoins, but there are thousands of other cryptocurrencies, and more created daily, so cryptocurrencies have no supply limit, as Bitcoin fans claim.

Bitcoin is software. Microsoft Windows is also software. Would you agree if someone tells you that Windows has no intrinsic value because there are many operating systems and any team can create more operating systems?

There are many colas, but only one Coca-Cola.

Why does the US dollar have any value? Any country can create a new currency. There are 100+ currencies in the world. Is the dollar worthless because the Zimbabwean dollar is worthless?

3. But no country will ever price its products in Bitcoin, so it has no future.

I agree that it's extremely unlikely any major country will ever price its goods and services in Bitcoin.

However, nobody prices anything in gold grams, either. Does that make gold useless?

Only the Swiss price things in Swiss Francs. Does that mean the Swiss Francs are worthless and useless?

Bitcoin can be an international currency without anything being priced in Bitcoin. If Tanzanian wants to send shillings to a Congolese, she will have to convert her shillings to dollars, send the dollars, and then the Congolese will have to convert those dollars into Congolese Francs.

Instead of using the dollar, which requires a bank account and high bank transfer fees (e.g., Western Union), Tanzanians can send bitcoin, which has a much lower transaction fee.

4. "The point is that a real currency’s primary “intrinsic” value is as a medium of exchange or a measuring stick for value. If a centimeter or inch on a measuring tape were constantly changing in physical size, it would not be particularly useful to ask for a six-inch sub. It might end up being the size of an airplane." - The Unassuming Banker

He should call himself the "Unintelligent Banker." Do Australians say they can't use the US dollar because its value constantly changes?

Indeed, the USD is constantly changing from the point of view of another currency.

Gold's value changes every minute - in relationship with every currency on Earth - including bitcoin.

5. But no matter which currency you compare Bitcoin to, it's too volatile.

True, the more it grows in market cap, the more stable it becomes.

It's far less volatile today when compared to when it was worth less than $200 million.

When it reaches the value of gold ($10 trillion), it will be as volatile as gold.

Bitcoin is a top 5 currency, bigger than the British Pound and behind the Yen, Euro, Yuan, and US Dollar.

Furthermore, bitcoin is far less volatile than some hyperinflating currencies (e.g., the Venezuelan bolivar, the Zimbabwean dollar, & the Argentine peso). If you believe that the US dollar will devalue in this century, then bitcoin will, one day, be less volatile than the US dollar.

6. It facilitates criminal activity because it's anonymous.

First, every Bitcoin transaction is recorded on a worldwide public ledger. If you buy a meal with Bitcoin, that transaction will be recorded on thousands of computers worldwide.

Many companies and governments are analyzing Bitcoin's ledger and catching all sorts of criminal activity.

That's why most smart criminals have turned to more private cryptocurrencies such as Monero and Z-Cash.

This 30-minute documentary is an outstanding summary of Bitcoin's implications

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

If you prefer to do a one-time contribution, you can send it to my PayPal at

If you prefer giving me Bitcoin, then please send BTC to my tip jar: 3EiSBC2bv2bYtYEXAKTkgqZohjF27DGjnV