Today marks the 1-year anniversary of bitcoin's 3rd halving & my critique of Plan B's stock-to-flow model.

I reflect on:

- How the stock-to-flow model is holding up.

- Misunderstandings about my first S2F video.

- Who is right/wrong about the S2F model.

- A potential Bitcoin supercycle.

- Bitcoin's Achilles' Heel.

- What I think will happen in bitcoin's future.

Watch the video:

Or listen to the podcast:

Outline

00:00 Intro

00:22 1 year after the halving

02:50 I'm not a BTC bear

03:56 McAfee eating his dick

05:05 S2F has an extremely broad target

06:32 BTC Supercycle?

10:14 BTC's Achilles' Heel

12:01 Plan B Blocked Me

15:40 Price Predictions

18:45 Summary

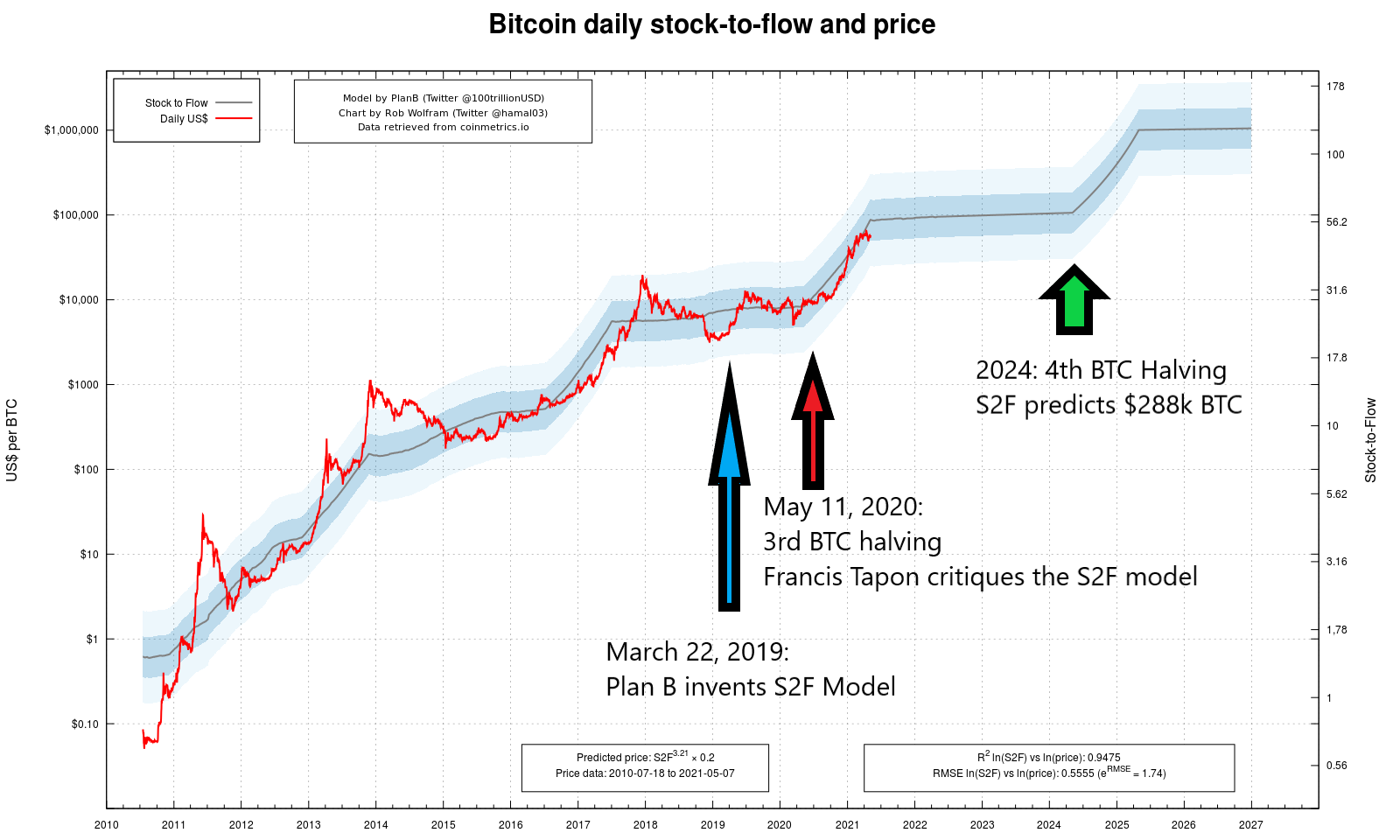

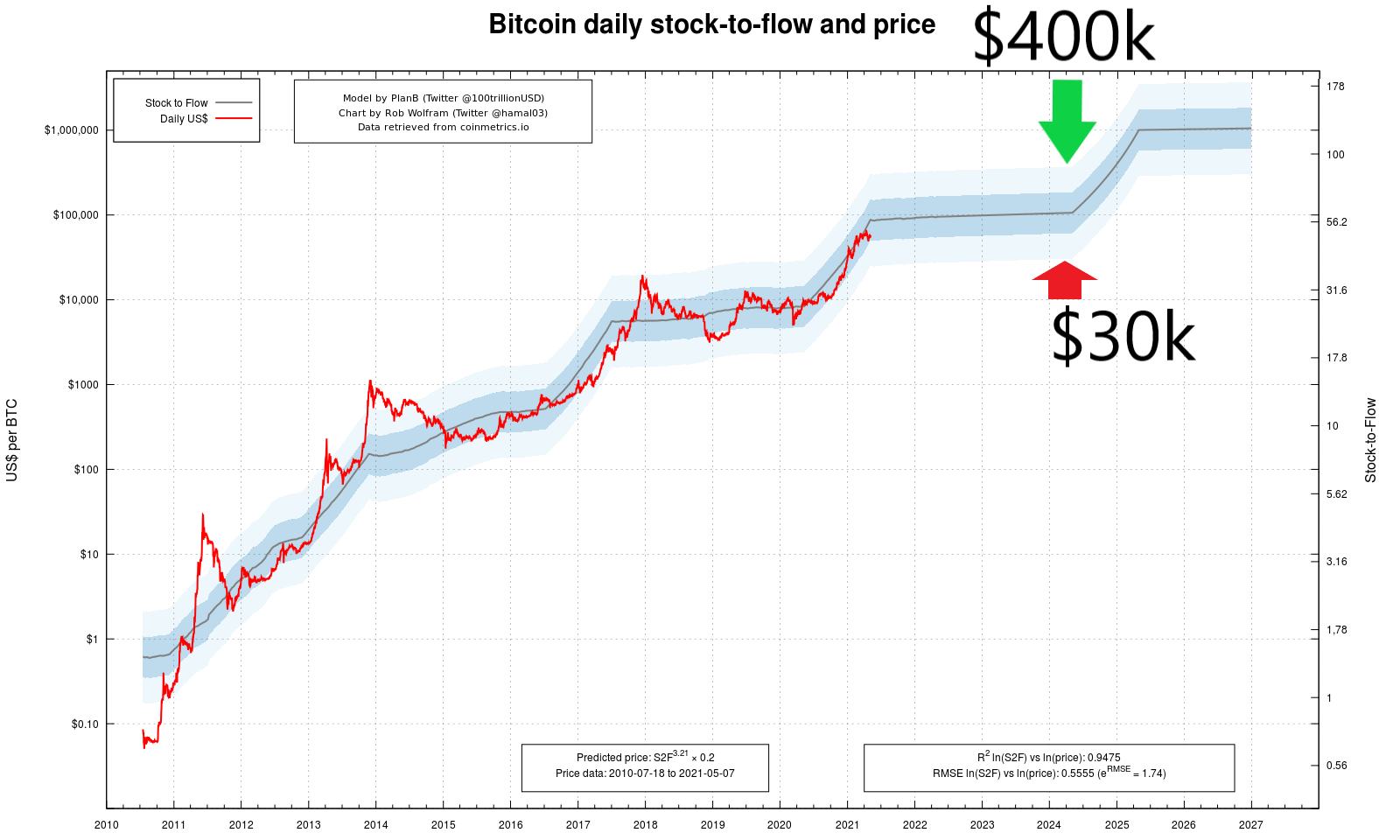

In the chart below, you can see the incredibly broad target that bitcoin's stock-to-flow model.

In 2024, when the 4th Bitcoin halving occurs, the model predicts that the price will be between $30,000 and $400,000!

That's such a broad range that it's almost useless and it nearly guarantees that Plan B can say that his model is right.

Still, he did say that the average price of BTC will be $288,000.

Therefore, if it languishes below $288,000 between now and 2025, most people will consider that bitcoin's stock-to-flow model will be dead.

Watch my 2022 update!

In May 2022, I reflect on the stock-to-flow model's progress or lack thereof.

Sponsors

This episode is sponsored by:

More info

You can post comments, ask questions, and sign up for my newsletter at http://wanderlearn.com.

If you like this podcast, subscribe and share!

On social media, my username is always ftapon. Follow me on:

- http://facebook.com/ftapon

- http://twitter.com/ftapon

- http://youtube.com/user/ftapon

- http://pinterest.com/ftapon

- http://tumblr.com/ftapon

My Patrons sponsored this show!

Claim your monthly reward by becoming a patron at http://Patreon.com/FTapon

Rewards start at just $2/month!

DISCLAIMER

The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses a considerable risk of loss. The speaker does not guarantee any particular outcome.