Step 1: Know your expenses

First, you must know your annual expenses. Add up the amount you spend every year on all your major expenses, such as rent/mortgage, telephone, clothes, education, utilities, entertainment, transportation, fitness center, and booze. There are software programs (e.g., Quicken and MS Money) that help you figure out your annual expenses, and for the frugal, there are free financial web sites (e.g., Finance Yahoo! and MSN Money) as well. The super frugal can get by with just a pencil and paper! It doesn’t matter what method you use, and you don’t need an MBA or a CPA to figure this out. Just get a rough idea. Are you spending $10,000 a year? $30,000 a year? $50K? $100K? More than $200K?

Step 2: Save until it’s safe to summit

Armed with that number, you can determine when it’s safe to summit. The more cash you have stowed away, the better you will weather downturns. How much cash is enough? In the US, most recessions last under 12 months. Therefore, saving a year’s worth of expenses will provide a sufficient buffer to weather nearly any recession. Once you have that level of protection, you can confidently adopt upgrades, as long as you maintain that one-year buffer. You can summit without fear. As a result, you will have the freedom to do what you love. Best of all, you’ll finally get to buy that deluxe barbeque set that your wife has been resisting.

If you live below your means and you control your desire to upgrade, you probably won’t notice recessions. Even if you are laid off, you won’t have to change your way of life. If you’re used to eating out twice a week, driving a Lexus, and schmoozing at the golf club, then you can still do that because you’ve saved a year’s worth of expenses. Although this will chew into your savings, you won’t have to tighten your belt (or at least far less than those who were overextended).

On the other hand, those who constantly push the envelope of upgrades and live on credit will have to retrench their way of life significantly. The process of cutting back is depressing for anyone. That’s why living beyond your means is so risky—you’re bound to get disappointed.

Step 3: Resisting upgrades

Most of us don’t have a year’s worth of expenses saved. We feel pretty good if we have a month! Getting a year’s worth of expenses saved requires resisting every tempting upgrade until your life becomes highly inconvenient without it. Before my thru-hike I learned to question every purchase. Ask yourself:

- You’ve gone this far without it, so is it really that important?

- Is there a truly compelling reason you need the upgrade today? Or can it wait a few more weeks, months, or even years?

- Has most of the world adopted the technology? Where is it on the Technology Adoption Cycle? Unless it’s reached the Must Have Phase, do you really need it? Do not compare yourself with your peers if they are affluent and/or keep-up-with-the-Joneses types. These people tend to upgrade before the majority of the population, and before it’s really necessary to upgrade.

Step 4: Always calculate nominal costs

Get into the habit of calculating the nominal costs of a reoccurring expense before committing to it. Figure out how much the subscription will cost you over a year, or even five to 20 years. When the next salesman tells you, “Hey, it’s only $1 a day!” Remind yourself that it’s $365 a year, and ask yourself if that extra $365 at the end of the year would be nice to have in the bank. Or you can suggest to the salesman that if it’s only a $1 a day, then why not just give it away?

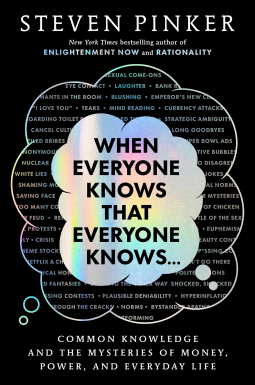

This is a modified excerpt from Chapter 2 of Hike Your Own Hike: 7 Life Lessons from Backpacking Across America. You can buy the book at my shop, Amazon, Apple’s iBookstore, Barnes and Noble, and Google Books. (The best deal is at my shop). It’s also available as an audiobook. The hardcover costs, over the course of one year, just a fourth of a penny ($0.0027) per day!