This is an excerpt of my upcoming book, The Unseen Africa. I'm sharing it with the hope that you can give me constructive criticism. It's unhelpful if you only write, "Everything in this stupid article is wrong!" If you disagree with something I've written, please say what exactly you disagree with and please cite evidence to defend your point. Simply calling me a "racist asshole" is cognitively lazy. Tip: the more polite your feedback, the more persuasive you'll be.

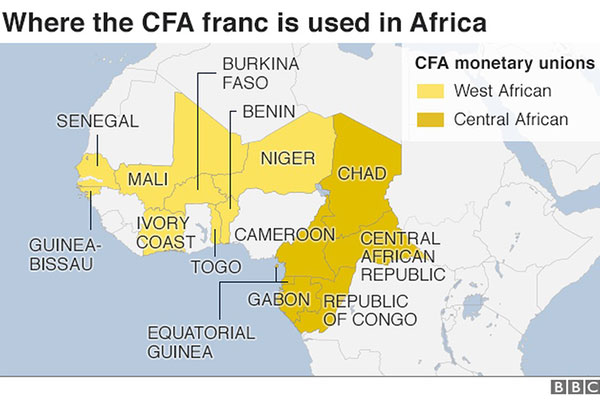

Let’s examine Africa’s most controversial and misunderstood currency, the CFA. It comes in two flavors: the West African CFA and the Central African CFA. Although the bills look different from each other, they are both pegged to the euro at the same value (1 euro = 656 CFA).

See photos to compare the 10,000 note of West Africa's CFA versus Central Africa's CFA. Both are worth 15.23 euros (about $20).

Money exchangers still charge a fee to convert between the two types of CFA, which is annoying. This odd two-flavor currency exists because the French had divided its largest African lands into two blocs (West Africa and Equatorial Africa). France wanted to give the two regions the option of valuing their currencies differently. They never have.

Nearly 200 million people in 14 African countries use the CFA every day.

To outsiders, the CFA seems benign, even positive. Anyone traveling through several Francophone African countries will immediately appreciate the benefits of a common currency just like they do in the Eurozone. The fewer money changers you must deal with, the better your life is.

However, to those who perpetually depict Africans as victims, the CFA is pure evil. They believe that the helpless CFA member states have forfeited their sovereignty to the nefarious French neocolonialists.

Since CFA members must hold half of their foreign currency reserves in the French Treasury, the Church of Victimhood believes that France is extracting wealth from poor Africans who have absolutely no control over their currency or financial destiny.

Naturally, the CFA critics claim the currency has not only impeded development, but it has also made it impossible for Africans to learn how to make a mouthwatering croissant.

The reality is more nuanced.

CFA brings monetary stability

The CFA’s conservative fiscal rules are a blessing, not a curse. Their existence explains why the CFA has been one of Africa’s most stable currencies.

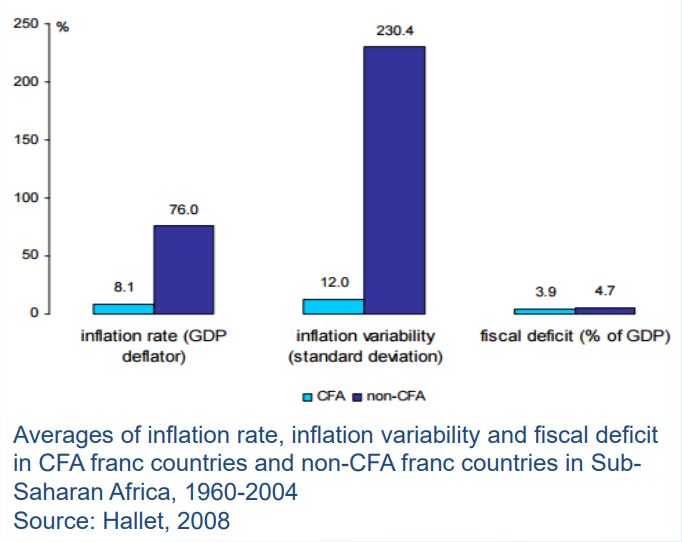

In the last 50 years, annual inflation averaged six percent in CFA-using Côte D’Ivoire, but 29 percent in neighboring Ghana with its volatile cedi currency. That story is similar throughout the Sub-Sahara (see graph above).

CFA countries have never suffered from the high inflation that has plagued so many other African countries that created their own Monopoly money.

If the CFA is so evil, why haven't more countries abandoned it?

If the CFA were so wicked, the CFA countries would have abandoned it long ago. Contracts can be torn up or renegotiated just like African nations did when they declared their political independence.

The anti-CFA crowd acts as if all the CFA countries are prisoners of their currency. They paint themselves as helpless victims to almighty France.

They’re not.

Here are five countries that decided to leave the CFA (and when):

- Djibouti (1949)

- Guinea (1960)

- Mali (1962)

- Madagascar (1973)

- Mauritania (1973)

This proves that no CFA country is bound by some immutable and eternal agreement to stay in CFA. They’re free to leave whenever they want.

And yet, most stay. Why?

Because they realize that they are better off in the CFA than out of it.

The proof is when you study the trajectory of the newfangled African currencies that emerged after they shed the CFA. Since 1980, the US dollar buys seven times more Mauritanian ouguiyas and nine times more Guinean francs. Madagascar’s ariary has lost half of its value in just the last decade.

Mali’s effort at inventing a currency was such a catastrophe that after 22 years of economic malaise it quietly rejoined the CFA in 1984 with its tail between its legs.

If the CFA were such a terrible currency, why did Mali choose to use it again?

Among the five countries that have exited the CFA, only one created a currency that did not spiral into worthlessness: Djibouti. That’s because when they created the Djiboutian franc in 1949, they pegged it to the US dollar. Thus, it’s remained Africa’s most stable currency.

If the CFA sucks so much, why did non-Francophone countries join it?

CFA critics never wonder why two non-Francophone countries joined the currency zone long after their independence. Spanish-speaking Equatorial Guinea voluntarily joined the club in 1985 and Portuguese-speaking Guinea Bissau joined in 1997.

Either all these Africans are stupid or they’re shrewder than we give them credit. They’ve clearly concluded that they’re better off being part of the CFA, despite its shortcomings. This is the same reason why Eurozone nations haven’t given up on the euro despite its many headaches.

The 1994 devaluation

Speaking of headaches, the CFA endured a headache in 1994 when it was devalued by 50 percent. Today, some still whine about that event and believe that France made that decision unilaterally.

The reality is that in the early 1990s Africans were complaining that their exports were uncompetitive because the CFA was relatively expensive (which some people still complain about today).

Therefore, some Africans wanted to do what China has done for decades: artificially weaken their currency to make their exported goods cheaper (and imported goods more expensive).

France complied. After the devaluation, CFA countries nearly doubled their exports and their GDP soared, but their people complained that imported goods were twice as expensive as before.

Complainers don’t understand this result is what happens whenever you devalue a currency. It's not a French conspiracy. It's just basic economics.

I know, it’s just so much more fun to blame the French for everything.

The CFA encourages Pan-African trade

Some say the CFA hasn’t encouraged intra-African trade because only 15 percent of all African trade happens within the continent. Intra-regional trade is higher in Latin America (19%), Asia (51%), and Europe (72%).

What impedes intra-African trade are the tariffs and other trade barriers that African countries have erected between themselves. If every CFA-denominated country were to create its own currency, you can be sure that trade would worsen.

Before the euro, the CFA pushed Africans to trade with France since the CFA was only convertible to the French franc. Now that the CFA converts to the euro, CFA countries have more easy trading partners to choose from. In 2017, West Africans rolled out the eCFA to digitize it.

But isn't France stealing half the reserves?

This myth comes from the fact that CFA nations must store half of their foreign exchange reserves with France's Treasury.

From that fact, conspiracy theorists proclaim that France is "robbing" Africans and using the funds to hire expensive Russian prostitutes.

What's really happening is that the 14 CFA-using nations need a central place to put their joint foreign reserves. Should they all place it in Senegal?

"Hell, no," say the Africans. "We don't trust the Senegalese. They could run away with our money."

Africans generally distrust other Africans. They have more confidence in a European government, where there is consistent accountability and rule of law.

France pays 0.75 percent interest on the reserves, which the French can't touch.

In 2018, Africans had about $10 billion safely kept in the French treasury. This is peanuts compared to France's $2.5 trillion debt. France isn't tempted to put its fingers in the $10 billion cookie jar, but Chad would be.

Examining the alternate universe: where the CFA never existed

The anti-CFA crowd argues that life would have been so much better if the CFA hadn't ruined the African party.

Fortunately, we don't need to defy the laws of physics and travel to an alternate universe to see how life would be without the CFA.

We just need to visit any West African country that is not using the CFA.

If the CFA truly hindered development, then why haven’t Liberia, Sierra Leone, Guinea, Ghana, and Nigeria left their CFA-using neighbors in the economic dust?

Instead, most of those five non-CFA countries are doing worse than the average CFA country.

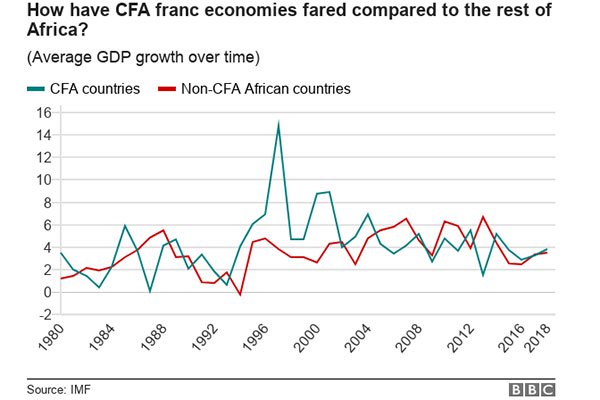

If the CFA-is-holding-back-Africa thesis were correct, we should see that the red line would be easily outperforming the blue line. It's not. If anything, on average, the CFA-countries have a slight edge over time.

By the way, the blue economic spike came after the 1994 devaluation of the CFA that we mentioned above. Yes, imports became more expensive, but because CFA-denominated goods were half as expensive after the 50% devaluation, CFA nations sold a lot of goods. That's why their GDP spiked. But GDP spikes raise the value of a currency, which slows down export-driven economic growth.

Few remember that four non-CFA countries shared a common stable currency (the British West African pound) from 1907 to 1962. Upon independence, nationalists instinctively rejected it because they were eager to design their own colorful currencies.

Today, West Africans have returned to the wisdom of a transnational currency. They’ve designed the eco, which should replace the CFA and get France out of the picture. That’s good because Africans really don’t need a paternalistic France involved in their currencies anymore.

The afro currency

Although the eco is promising, a better solution would be to adopt the afro, a Pan-African currency that should appear in the 2020s.

Although the eco is promising, a better solution would be to adopt the afro, a Pan-African currency that should appear in the 2020s.

For some countries, another possible solution would be to adopt the US dollar or the euro, just like El Salvador, Panama, Ecuador, Kosovo, and Montenegro have. After years of hyperinflation, Zimbabwe adopted the US dollar as its default currency. Africans could also create a regional currency that is based on a basket of currencies.

Finally, the most radical, brilliant, and innovative solution would be for Africans to make their standard Pan-African currency a flagless cryptocurrency (like Bitcoin). That would make it impossible for shortsighted politicians to recklessly play with their currencies.

Whether Africans shift to the eco, the afro, or the crypto, they will have to give up a bit of their economic sovereignty just like they did for the diabolical CFA.

Here are the regional common markets in Africa. The CFA helps intra-African trade, but the afro (or a cryptocurrency) would be even more powerful.

Conclusion (not included in the book)

CFA critics have:

- Overlooked the CFA's benefits (e.g., low inflation, facilitates trade).

- Unrealistic fantasies of how much better life would be without it.

- Ignored West and Middle Africa nations that don't have the CFA and are in worse shape than the CFA countries.

- Failed to explain why CFA-using countries stick with the currency when they could easily leave at any time (as some countries have).

- Not considered why non-Francophone countries have joined the monetary union.

Don't misunderstand me.

The CFA is indeed flawed. Although France's involvement is not nearly as bad as the CFA critics claim, France should still divorce itself completely from the currency. They should leave not because things would magically become so much better, but because it will take away a convenient scapegoat that some love to use to explain Africa's miseries.

Sadly, even if France completely disassociates itself from Africa tomorrow, folks in the year 3020 will still be blaming the French for why Africans don't have flying cars and don't live until 900 years old.

Why?

Because people love to make Africans perpetual victims. As long as Africa is behind the rest of the world, it's someone else's fault.

What I found surprising when I spent the last 5 years traveling through all 54 African countries is that most Africans take responsibility for the state of their affairs.

It's the foreigners (often energized by the White Savior Complex) or black pseudo-intellectuals who trumpet the negative notion that Africans are powerless and innocent.

The average African knows better.

So should you.